One reason a job at a Big 4 Accounting Firm is still (despite a fair bit of negative press over the last year or so) a sought-after role, is because of the exit opportunities you are presented with when you leave!

Let’s face it, working in public accounting, specifically in the “Big 4” can grind any living, breathing person into less-than-optimized version of themselves. There are a lot of hours, a lot of politics and posturing, and a wide variety of people you have to spend a lot of time working with.

When to Exit the Big 4

Before you fully make the leap, it’s worth thinking through some different factors to make sure it makes sense. That said, your sanity and physical/mental well-being are most important … so if your experience is something that is beyond a ‘grind’, you need to do what is right for you! Here are some factors to think about:

Personal Goals and Aspirations!

This is maybe the most important! What do you want out of your career? Do you want more interesting work? Do you want to work in a particular industry? Do you want to be in Private Equity or Investment Banking? Do you want to be a CFO? Think about what YOU want!

Level of Experience

Many people aim to leave the Big 4 after reaching a certain level on their career path which clusters around 3-5 years. It can be a great milestone to get to the point where you have direct reports since manager (people leader) positions can be a less structure/natural progression outside of the Big 4.

The landing places you find on the outside will vary based on when you leave. Here is a good Reddit post on “how long should you stay at big 4 before leaving for something better“

Key Milestones & Qualifications

Part of Big 4 experience is building up that resume. Depending on which area you work in (Advisory, Audit, Consulting, Tax), you may have a deal or project you want to see through. If you are working through it, you also want to earn your CPA (or equivalent) as Big 4 firms are very supportive of achieving those certs (and often pay for them or give you resources).

Job Market

The job market plays a crucial role. It’s advisable to transition when the market is strong, and there are ample opportunities in the industries you’re targeting.

If the job market is tighter, sometimes the more defined career path of public accounting (so long as you are progressing) can be a better trajectory.

Time it to not Burn Bridges

Many choose to leave their roles after a busy season or after a project. This can make sense because this gives you time to do your job search and interview.

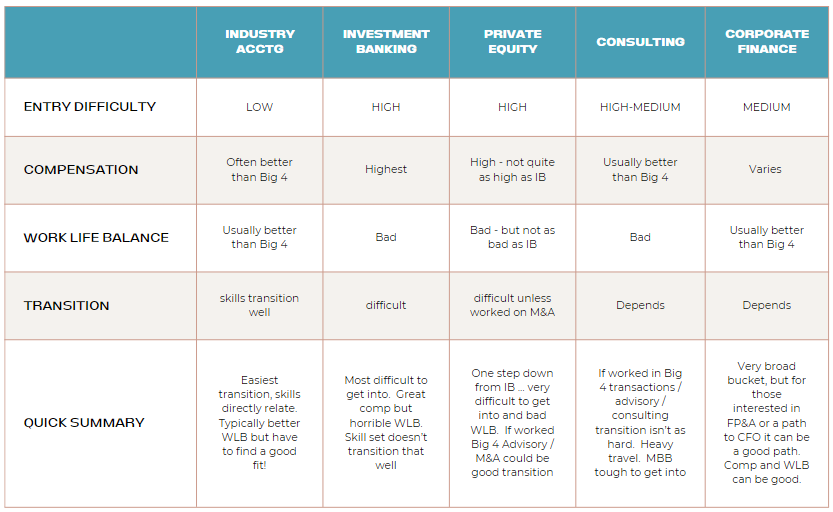

The Exit Options

There are many options for the post big 4 chapter of your career. The choice that makes sense for your will obviously depend on which areas of the big 4 you have experience in (Advisory, Audit, Consulting, Tax, Transaction Services)… your experience will also help dictate whether or not you are a candidate!

“Industry” Accounting

You will hear this term frequently. This is probably the most common (and also probably the easiest), transition. Skillsets are very comparable in Big 4 roles vs. Industry roles, but usually Industry is going to have a better blend of compensation and work-life balance

What is it:

If you work in Big 4, you probably already know pretty well what working in “industry” means, but I’ll give a quick overview.

Working in industry means taking an accounting position (senior accountant, accounting manager, controller, assistant controller, etc) at a company within the accounting function. It could even be within internal audit.

The work involves managing and reporting a company’s financials and assuring compliance with accounting standards. This role emay include: maintaining financial statements, managing ledgers, preparing and analyzing financial statements, ensuring compliance with regulatory requirements (managing audits), and more.

Corporate accountants often play a big role in budgeting, forecasting, planning, and supporting strategic decision-making within a company. This varies a bit from company to company depending on work splits between ‘accounting’ and ‘finance’

Naturally, the work requires a strong understanding of accounting principles, attention to detail, and the ability to navigate ERPs, reporting systems, and the like. Collaboration with other departments, especially finance, but also operations and sales, is very important.

What is compensation like:

Compensation varies tremendously depending on the role, experience, and size of the company. The compensation can increase quickly as you gain experience and move into roles like Senior Accountant, Accounting Manager, or Controller. The compensation will include a base salary and bonus, and as you advance it may also include equity or profit sharing.

This role offers a stable and often lucrative career path, with the potential for steady growth in both responsibilities and compensation.

Other considerations:

With industry accounting, you have to remember that experience can vary dramatically. Here are a few other notes of things I have seen…

-

Many that leave Big 4 instantly feel relief from the grinding pace and difficult hours. They immediately think, how did I ever do that!

-

Over time, some can actually feel like industry moves too slow! Or they feel that their career path is not as well-defined as it was when they had the well known logical promotion path that the Big 4 firms offer.

-

The first role at the first company might not be the right fit. Sometimes you land in a place that is a ‘dumpster fire’, has limited accounting talent, is going through some messy M&A or sales process, or is far too lean which leaves you in the same boat you were in through your Big 4 days! You may not find the ‘right’ job with your first role post-Big 4.

-

I always recommend people leaving Big 4 to find either rekindle or to find some new hobbies. At the end of the day, for many people, they work to live (vs. live to work). Find things that make you happy and you will likely enjoy your work a bit more

-

Big 4 Exits and Reddit … I often look to Reddit to get people’s unfiltered (and sometimes a little crazy) thoughts on a subject. Both the “/Accounting” and the “/Big4” subreddits skew a bit negative, but here are a few of the best posts I found on transitioning: Opinions on moving to industry after 2-5 years, Experience switching from Big 4 to Industry as a Senior Manager,

“High Finance” #1 Investment Banking

This is often the ‘holy grail’ of finance. Getting into IB or PE, it’s the talk of finance bros in colleges and universities across the world. The land of button up shirts and high-end outdoor outfitter vests.

What is it:

Investment bankers play a pivotal role in the financial services industry, advising clients on significant financial transactions, including mergers and acquisitions (M&A), initial public offerings (IPOs), and other types of corporate finance activities.

What is the work like:

Kind of brutal, honestly. Typically, working at an investment bank means long working hours, often clocking 80+ hours per week. They are going to be grinding through deal models, deal preparation, client presentations, and other research. The work requires exceptional quantitative skills, attention to detail, and the ability to work under tight deadlines. Analysts often have undergraduate degrees in finance, economics, or related fields, and many progress to an associate level after a few years, or after completing an MBA.

As they advance, investment bankers take on more responsibilities, including leading deal teams, developing client relationships, and strategizing on larger transactions.

The culture in investment banking is highly competitive and high-pressure. However, if you embrace it, you will ramp up your skill set very fast. IB also sets anyone up for even better exit opportunities than Big4 and pays very well. it is also known for its steep learning curve and the opportunity to develop a robust skill set in financial analysis and corporate finance. These skills are highly transferable and valued in many other areas of business and finance.

What is compensation like:

Compensation in investment banking is among the highest in the finance sector, with bonuses making up a large portion of the total compensation, especially at higher levels. The industry also offers excellent networking opportunities and a platform for a successful career in various finance-related fields, including private equity, venture capital, and corporate finance.

Check out this guide for more detailed info on IB Compensation, but suffice it to say even associates can bank numbers 300-400k+ in total compensations.

“High Finance” #2 Private Equity

This is the frequent ‘runner up’ to IB in terms of most sought after & highest paid. You might not see as many Patagonia vests, but there will still be a fair number.

What is it:

PE firm deploy cash (could be equity, could be debt) and acquire entire companies or portions of companies. They try to drive rapid growth (often with a ‘roll-up’ strategy) and then cash out. They frequently shoot for a hold period of around 4 years.

What is the work like:

Working in PE will depend on your level, but it will have you doing a mix of of analysis, modeling, due diligence, and managing portfolio companies (port cos), as you get more senior you will also usually sit on the Board of some of those port cos.

Effectively, you are either working on acquiring new companies (for this you work on deal models and financial due diligence), growing existing companies (working with the management team of the port co and perhaps working on M&A for that company), working through selling existing companies, or through the transitions on either side of selling/buying. An accounting background can be very helpful for some of the due diligence tasks for sure!

It’s not all deals. Over the hold period of the company PE is always pushing their management teams to make operational improvements, commercial improvements, deploy better financial processes, and more.

The environment is typically slightly less hectic than investment banking but requires a deep commitment and you are almost always ‘on’.

What is comp:

Compensation in private equity is highly competitive and often exceeds that of many other sectors in finance (expect IB). Here is a great guide for more details. The comp typically consists of a base salary and a significant bonus component, which is usually tied to firm (and sometimes individual) performance.

The bonuses can be substantial, especially at senior levels, as they are often linked to the profits generated from successful investments.

The more senior you get, the more likely you are to receive carried interest, which is a share of the profits generated by the fund. Carry truly will be determined by how well the particular fund does.

Corporate Finance (FP&A focused … also business partners, treasury, etc)

Often when people leave the big 4, they are tired of the grind. I think for many, jumping to IB or PE makes them want to puke! Often, the solution is found in sweet old corporate finance. Particular finding roles in the F500 or F1000 type companies that have more people, more mature processes, and so on… can grant that decent balance between compensation and work-life balance.

What is it:

Working in corporate finance is such a broad category. It is basically any job within the finance function of a company, but for this we are going to hone in on more common Financial Planning and Analysis (FP&A) roles that are becoming more and more critical within the corporate finance hierarchy.

FP&A is a blend of financial forecasting, budgeting, analysis, and financial reporting… but increasingly requires a strategic element to all of those.

When done right, FP&A plays a crucial role in shaping a company’s strategy and decision-making. The work primarily includes preparing financial models to forecast performance, analyzing financial trends, and providing insights to support decisions. FP&A teams also develop and manage budgets, evaluate performance against budgets and KPIs, and report on variances and their implications.

The role demands strong analytical skills, proficiency in financial modeling, and an ability to communicate complex financial information clearly to stakeholders. FP&A professionals often work closely with senior management, offering a holistic view of the company’s financial health and guiding strategic initiatives. The job requires a good balance of technical financial knowledge and business acumen, making it a dynamic and impactful role within any organization.

What is the work like:

Working in PE will depend on your level, but it will have you doing a mix of of analysis, modeling, due diligence, and managing portfolio companies (port cos), as you get more senior you will also usually sit on the Board of some of those port cos.

Effectively, you are either working on acquiring new companies (for this you work on deal models and financial due diligence), growing existing companies (working with the management team of the port co and perhaps working on M&A for that company), working through selling existing companies, or through the transitions on either side of selling/buying. An accounting background can be very helpful for some of the due diligence tasks for sure!

It’s not all deals. Over the hold period of the company PE is always pushing their management teams to make operational improvements, commercial improvements, deploy better financial processes, and more.

The environment is typically slightly less hectic than investment banking but requires a deep commitment and you are almost always ‘on’.

What is comp:

Compensation in FP&A varies depending on the level of experience, company size, and industry.

There is significant potential for growth in FP&A. The FP&A leaders for F500 companies often top out with total comp packages into 7 figures.

Within FP&A you will typically get a base salary, a bonus, and once you get to Director level or above, you may get equity compensation as well (this could be stock grants, RSUs, options, etc).

Other Notes:

Here are a couple good reddit posts on moving into FP&A: big 4 audit to FP&A, Big 4 Audit to FP&A without CPA, and Anyone transitioned from Big 4 Senior Manager to FP&A

Consulting

Depending on your role within the Big 4, consulting might be similar to what you are already doing. Nonetheless, one exit opportunity some folks take is moving from Big 4 to Consulting (many focus on the MBB firms).

What is it:

Management consulting involves helping to guide organizations to improve their performance and solve business problems.

Consultants work on a variety of projects across different industries, which can range from strategy, operational improvement, and MUCH more… this really can be a broad spectrum.

The work is fast-paced and requires analytical skills, problem-solving, and effective communication. Consultants often work in teams as well as partnering with people in the company they are supporting. Ultimately, they are going to develop recommendations for their clients.

They need to adapt quickly to different business contexts and work environments, as they frequently travel and engage with new clients. These roles (especially at the top firms) have long hours and keep you ‘on call’ most of the time, but it is great from an experience and learning perspective.

What is the work like:

Working in PE will depend on your level, but it will have you doing a mix of of analysis, modeling, due diligence, and managing portfolio companies (port cos), as you get more senior you will also usually sit on the Board of some of those port cos.

Effectively, you are either working on acquiring new companies (for this you work on deal models and financial due diligence), growing existing companies (working with the management team of the port co and perhaps working on M&A for that company), working through selling existing companies, or through the transitions on either side of selling/buying. An accounting background can be very helpful for some of the due diligence tasks for sure!

It’s not all deals. Over the hold period of the company PE is always pushing their management teams to make operational improvements, commercial improvements, deploy better financial processes, and more.

The environment is typically slightly less hectic than investment banking but requires a deep commitment and you are almost always ‘on’. These roles can also require a high amount of travel and time on the road.

What is comp:

Compensation packages are on the high end of the spectrum, which is consistent with the work required! Management consulting is going to typically be below investment banking and private equity, but just above corporate finance and industry accounting.

As consultants progress to more senior roles, their compensation increases significantly, often including larger bonuses, profit-sharing plans, and other benefits.

The industry is known for its lucrative pay scale, especially at top-tier firms. The total compensation package typically reflects the consultant’s level of experience, the firm’s prestige, and the success of the projects they have worked on.

Other potential Exit Opportunities:

Corporate Strategy & Business Development

I’m not going to go into as much detail here, but these can be fun roles to spin into after Big 4. If you have deal experience and worked in financial due diligence, advisory practice, or transaction services, it can also be a very natural transition.

These roles are often highly involved in M&A work and growing a business. They also sometimes have a great intersection between Corporate Finance and PE, since the active M&A firms are often investments in a PE fund (PE-owned).

Top MBA programs

Depending on your goals, it could be a great fit to get into one of the top 20 or so full-time MBA programs. Your Big 4 experience combined with a Top 20 MBA (complimenting your accounting degree) could open many different doors for you, especially if you want to move beyond finance/accounting.

How to Execute on Leaving the Big 4

It’s time. You have reviewed everything and you know your time spent in PA is over. Now, what to do…

-

The very first thing you need to do is decide what path you want to take. Do you want to do IB, PE, Industry, FP&A, consulting, etc.. The process will be very difficult if you can’t decide what direction you want to go.

-

As a part of this, you should also define where you are willing to live, how much you are willing to travel, how much you are good with going into the office vs. remote/hybrid. These are things you should know going in.

-

-

Refresh your resume! You may even consider paying a professional to help you out here. Resume’s typically aren’t going to ‘get’ you a job, but a poorly done one might cost you a job. Get it done, make sure it is good. If you don’t pay a professional, at least make sure you get 5-10 reviews from peers, mentors, former managers, etc.

-

Update your LinkedIn. This goes hand in hand with updating your resume, but is 100% necessary. Make sure it is crisp and make sure you have a professional head shot on your profile. You can switch on the ‘covert’ open to work to let recruiters know you are interested. You may be surprised how highly sought top accounting talent is right now.

-

Talk to recruiters and form relationships. There are different recruiters for different career paths, start to reach out to those recruiters. You want to form real relationships with these folks. I have ongoing relationships with 3-5 recruiters that I connect with regularly. Always be cordial, and you may also be able to help them sometimes by connecting them with people in your network.

-

Start using your network. You should start letting know your network that you are ready for something new. This can be the most valuable asset in your job search if you do it right.

-

Prepare what you can. Depending on what area you are looking at, start to self assess and build talking points for interview questions or technical questions you may come up against in interviews. Do your homework on how different companies and businesses recruit, and so on.

How to Explain your Big 4 Exit

When you start the interview process in one of the different career fields we mentioned above, you will inevitably get asked the question, why are you leaving? It is important to be prepared to answer this…

The key to answering this question is to flip the question around a little bit… Don’t answer why you are leaving … Instead, talk about why you want to job that you are applying for.

Let’s say you were looking for a role as a controller or accounting manager at some F500 company. Here is how you might answer the question.

“It’s less about wanting to leave my current role, and more about what I want to do with my career. Ultimately, I want to be IN the business. I want to be working cross functional to help a business hit it’s goals. I want to have solve problems. I want to get experience working closer to the operations of a business vs. being solely focused on (insert whatever you are currently doing”.

This gives you a way to answer the question in a very positive light … vs. saying “I’m leaving because busy season is sucking the life out of me!” 🙂

First Hand Stories of Big 4 Exits

Big 4 to Small Firm Advisory

There are some great places on the internet to get first hand accounts from people on their personal experience with exiting out of Big 4 Public roles. Typically, I find these on Reddit or some of the finance forums (like Wall Street Oasis). I spent some time to find a few that I thought would be helpful.

This example is of a “Big 4 Exit Success Story” showcases an accountant that left E&Y. They were a CPA with just over 2 years of big 4 experience that landed a job at a smaller advisory practice and was able to increase their comp by 36%!!! Their advice … leave as soon as you get that senior title!

Big 4 to Investment Banking

In this post a few users trade stories about transitioning from Big 4 to IB. There isn’t a ton of information, but there are a few details on IB recruiting, IB salary, and a few other details. It’s worth a read and there might even be some people in there to DM to learn more!

Big 4 to FP&A

I find that often after a few years in accounting in the corporate world, many accountants are interested in sliding over to FP&A. This can also be a good transition for people who want to move out of the Big4. This post talks a bit about how your accounting experience can help you, but also gives some reasons that it could still be tough.

General Exit Success Stories

I like this post on Reddit which has a few people discussing their exits into different fields (consulting, FP&A, IB, and more). It’s a good dialogue where you can hear different perspective.

Some Closing Thoughts on These Exit Ops

It’s so important to think about what you want. Spend time talking to people in your network that have landed in these places. Make use of the plentiful forums on Reddit, Mergers & Inquisitions, Wall Street Oasis, and many other sites. When you post on these, you will illicit some strong responses, but you also will be surprised how many people with relevant experience are willing to DM with you and help talk you through their experiences.

As I mentioned earlier, you also have to remember that everything is a little hit or miss. Sometimes you don’t find the perfect job opportunities or you get an offer and once you start it isn’t as good as you thought. It could be you picked the wrong area (IB, PE, Industry, etc) or it could just be you landed at the wrong company or in the wrong team (more specifically under the wrong boss!).

A career really is a ‘marathon’. Sometimes early in your career it can be hard to see that, but you will probably have some jobs that are a dead end and you will have some jobs that are your favorite. There will be different opportunities that come along and sometimes they just aren’t at the right time for you personally.

Take your time, think things through, and try to trust your gut and your mentors!