I’m sure you’ve seen the headlines like “The Demise of CPAs” or “Artificial Intelligence to Replace all Accountants.” Spoiler alert: these articles are 100% wrong. Accountants are here to stay. And what’s more, accountants will soon be the cool kids on the playground, pocket protectors, calculators, awkwardness and all.

But if you really want to be the bees-knees in business, the old accountant inside of you needs to die and a new accounting hero needs to be born. With that, new skills are required in accounting. But I’m getting ahead of myself. Let’s start with why a rebirth is necessary.

Technology is rapidly changing the industry

After years of resistance, accounting is finally harnessing today’s latest technologies. This change is radically affecting everything an accountant does. So what are these technologies?

Artificial intelligence, block chain, machine learning, oh my!

Every time you read the latest headlines, inevitably one of these three buzz words will creep in. However, like most people, you probably have no idea what this mumbo-jumbo means. Let’s change that:

Artificial Intelligence

Basically, this is the ability for a computer to think and learn (robots are going to destroy human-kind!). We use AI for things like speech recognition (“Hey Google, how much wood can a woodchuck chuck?”), self-driving cars, and interpreting complex data.

AI is put to use where computers can perform better than humans. The most relevant example for us is searching data bases and doing calculations. Computers can do this 1,000s of times faster and better than humans. However, AI fails when it comes to basic judgement. Computers can outsmart humans in the most complex data analysis but can barely identify a cat in a picture, something my 3 year old daughter Kate can easily do.

Google PixelBuds can translate what the other person is saying into your native language, in real-time.

this just blows my mind!— Soumith Chintala (@soumithchintala) October 6, 2017

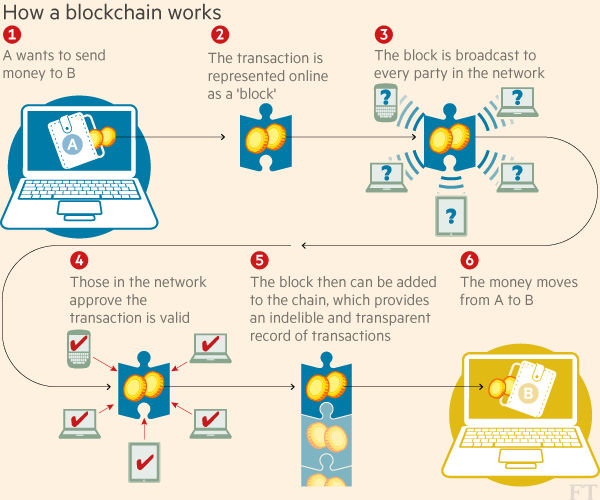

Block Chain

At its core, block chain is a distributed, public ledger (wow, that made it super clear). Okay, think of it this way. In a normal system, all information/records are stored in one place. Think of a normal accounting system. Therefore, if you wanted to defraud the company, you just need to manipulate one piece of data.

However, with block chain, each record gets its own unique identifier and becomes part of a chain of transactions. Additionally, anyone who accesses the data will receive a copy of the chain. That means, if you wanted to fraudulently manipulate one piece of data, you’d need to do it on the thousands of machines that have a copy of the chain! Therefore, block chain makes fraud almost impossible.

Machine learning

This is a subset of artificial intelligence. Machine learning allows a program to become more accurate in predicting outcomes without being explicitly programmed to do so (this is the artificial intelligence piece). This is what Google is doing every time you search for the latest Lord of the Rings news. As the algorithm receives input data (your search queries, where you scroll, where you click, etc.), the algorithm uses statistical analyses to predict an output. As it receives more data, the algorithm becomes better and better at predicting outputs.

What does this have to do with accounting?

With those definitions, let me share a few examples of how these technologies are radically changing accounting:

- In auditing, machine learning and AI allow auditors to analyze incredible amounts of data (every single transaction) and not just a sample size of 25. This means audit quality will increase tremendously. Additionally, this will allow firms to quickly and automatically audit lower-risk areas and focus on higher-risk areas/items that require more judgement (remember, computers stink at judgement). Machines are basically going to perform large parts of an audit for you.

- In tax, there is a push (and some countries like Brazil are already implementing) to have the taxing authorities have real-time access to all of your company’s transactions. This means tax prep work will be all but automated. Chris DeVito, a tax director at Johnson & Johnson, said that “the government will calculate the tax return for you; tax compliance professionals should have very little manual work to perform.” Result? Tax preparation business will begin to evaporate as countries adopt this practice.

- Computer algorithms can rapidly analyze all of your client’s data (financial and other) to identify trends and help with forecasting. These analytics are helping companies make operational and financial improvements and find hidden opportunities. In just a few minutes, analytics platforms like Tableau and Power BI can analyze data and identify trends better than you ever could.

- KPMG recently launched KPMG Spark. Spark is a small business tax and accounting service. I know what you’re thinking, “Wait, KPMG is a Big 4 and only deals with Fortune 1000 companies.” They used to. But as Jeffrey LeSage, Americas Vice Chairman – Tax at KPMG put it, “Robotic process automation, intelligent automation and other emerging technologies are just beginning to disrupt the accounting and tax services industries.” Translation: Technology has allowed us to go after the small accounting firms in a profitable manner.

Does this mean accountants are doomed?

Yes and no. If you bury your head in the sand, the wave of change will sweep right over you (and I’m not talking about a warm-Caribbean-wave…think arctic wave). Bookkeeping services will largely be automated. Tax prep services will be all but obsolete. Analytic companies have way better tools to analyze data. Algorithms will be able to automatically audit most lower-risk accounts.

Without doing anything, your skills will quickly become obsolete, your firm’s business will decline, and you’ll either be bought out or go under. Put simply, the skills that were sufficient yesterday are NOT the skills required in accounting today.

I know, I know, that is a lot of doom and gloom on my part. I’m sorry about that. I have to share this to wake you up to the realities of today. But there are a TON of rainbows, unicorns, and opportunities that go along with this change.

Behold, the new accountant

The truth is that we are going to need CPAs more than ever. Their role is to try to figure out and mitigate risk at every stage, and to say, ‘If we do it this way, here is the tax implication. If we do it this way, this is the cost implication.’ The profession is going to continue to flourish.

Half of the work the CPA does is to deal with people, to have relationships with people, and to decide how to work with their desires, their direction, and their vision for their business. That is never going to be replaced by a machine

Kevin O’Leary

Thanks, Mr. Wonderful, for putting it so perfectly! And may I say, I couldn’t agree more. Accountants are 100% here to stay and the industry will continue to grow. Let’s explore what the new roles of an accountant are given this changing environment.

A consultant

Anyone can be a numbers cruncher. This is not what makes someone a good accountant. Don’t get me wrong, you NEED to know how to crunch numbers, but you need to go 3 steps beyond that. You need to use your industry knowledge, experience with other client businesses, and mastery of the numbers to strategically guide and direct your clients.

I recently met with our accountants (KLR) about our tax return. They did the obligatory boring tax stuff for us which could be done by most mindless monkeys. However, after discussing the tax stuff, they started probing us about our business and asking really awesome questions. They dug deeper and deeper, getting past the high-level stuff and into the nitty-gritty.

After digging for 20 minutes, they emerged with incredible advice that has served us very well. They shared what has made other clients in our space successful, trends they’ve seen in our industry, and their experience at their own firm. They then provided advice on how we could improve our business model. And not only that, they gave us contacts of people we could reach out to to help grow our business.

We walked away utterly amazed. Needless to say, the money spent on “tax prep” services was well spent.

This is what you need to be to your clients. Regardless of your accounting role, you have access to company executives and vasts amounts of data. Utilize this and your vast experience to help your clients grow their business. This is something a computer can NEVER do.

Additionally, as industries mature, tax code becomes more complex (think about how much “simpler” the 2017 tax reform made business taxes), and companies expand across states and borders, companies will pay to have smart, trusted accountants advise them on strategy. Your advice will help propel their business and navigate them through potential landmines.

Start putting your big, beautiful brain to work and you’ll get more business and stickier, longer-term clients.

An analyst

Your clients have tons and tons of data gold buried deep inside their databases. The problem is, most of them have zero idea how to fully utilize and monetize this data. This is where our brilliant accountant/analyst comes in.

As an accountant, you likely have access to a lot of your client’s data. At a bare minimum, you have access to their financial records. Imagine what your client would think of you if this happened…

You’re hired to perform tax services for a mid-sized company with $10 million in revenue. The company has been around for 25 years and has been doing things mostly the same way ever since. You do the obligatory tax services but then you start to go crazy with the data.

You first start to analyze revenue trends by weeks, months, and geography. Next, you overlay industry indicators and macro economic trends on top of this data. Finally, you run this data through a regression analysis. What you come up with is a model for projecting revenue.

You then start the meeting with the boring tax stuff but then say, “But wait, there’s more!” You then whip out your model and proceed to tell your client how you can help them better forecast sales, inventory, etc. using this model.

My guess is, your client will excitedly wake up from their tax-induced coma and start jumping up-and-down with utter delight.

A communicator

Whether it’s warranted or not (but let’s be honest, it’s warranted), the world views accountants like this:

People stereotype us as introverted number crunchers who find it difficult to carry on a 5 second conversation without shriving into a ball and crying.

If this is you, it’s time to change. You can no longer stay safely hidden behind your Excel spreadsheets. Being an effective communicator is going to perfectly round out your consulting and analyst skill set.

As an effective communicator, you’ll be able to lead effective and informative meetings with your clients. You’ll be able to: a) present your deep insights and findings to executives; b) stand in front of a large conference and impart your vast amounts of wisdom; c) speak clearly and confidently to your clients and potential clients and; d) comfortably network with other people.

Basically, without effective communication skills, it won’t matter how good of a consultant or analyst you are.

What skills are required for accounting today?

Now I’m ready to discuss the top skills you’ll need in order to adapt and thrive in this brave new accounting world.

The soft skills

- Presentation: Presentations can range anywhere from presenting a brilliant tax strategy to a small group of executive to presenting your big ideas to hundreds of people. Regardless of size, the skills are exactly the same: a) beautiful, engaging, and concise PowerPoint deck; b) simple, jargon-free speech; c) ability to connect with the audience.

- Effective communication: It doesn’t matter how amazing your ideas are if you are incapable of effectively communicating them to your clients or team. One of the most important communication skills is honing your writing skills. Most accountants are comfortable with numbers, not words. You’ll set yourself far apart if you’re able to speak and write effectively.

- Networking: I’m not just talking about those giant, awkward-filled networking events. I mean being able to meaningfully connect with clients, potential clients, co-workers, and everyone else you come in contact with. As you build these authentic relationships, you’re ideas will have more merit and credibility.

The hard skills

- Data analytics: This one should’t be a surprise given the whole “you need to become an analyst” comment above. But really, you need to learn how to take large amounts of data and make sense out of it all. Further, you need to know how to apply the analyses to your clients.

- Data visualization: We may feel comfortable with piles of numbers on a spreadsheet; however, almost everyone responds more favorably to visuals. Beyond just analyzing data, you’ll need to know how to properly visualize that data to make it meaningful to your client.

- Financial modeling: This is one of the most powerful skills you can learn. Yet is amazes me that even though accountants live in Excel, very few of them can build a complex, dynamic financial model. These models will help you and your client understand the impact of decisions and perform scenario analyses.

Where can I gain these skills?

Okay, we know we need to adapt. We know the type of accountant we need to become. And now we know some key skills required in accounting. So, how can you actually gain this skills?

Well, there is a paradox in accounting. We are required to get 40 hours of CPEs each year to maintain our CPA license (check out our free CPE tracker here). Yet, with all of this “learning”, it’s rare to have a CPE course that is actually meaningful. Additionally, most CPE courses only concentrate on the technical skills, like regulations. To gain the hard and soft skills you need you can:

- Bring in a specialist to train your team: In-person training is amazing and very personal. But this type of training is usually a one-off training and can be tricky to get everyone at the firm to participate. Plus, once the training is over, you usually forget 75% of the material within an hour.

- Utilize an online resource: Wisdify offers high-quality, engaging online courses geared towards the most important hard and soft skills. We are constantly adding more courses to ensure you’re skills are always up to date.

- Conference: There are many wonderful conferences put on by state CPA societies and other organizations. The downfall is these usually are full-day events and usually focus on bigger-picture themes and not specific skills.

Conclusion

So there you have it. The accounting industry is changing in monumental ways and at an incredibly fast speed. But accountants are not going anywhere anytime soon. In fact, there is a huge dearth of accountants in the world! With this change, it’s imperative that you keep your skills up-to-date and change the way you do business.

With that, go forth my lovely accountants, and show the world that accounting nerds are the new cools kids on the block.

Remember, right here on Wisdify we have online CPE for CPAs where you get unlimited access to our CPE classes for your subscription!